Find you way back…

Corrections and adjustments

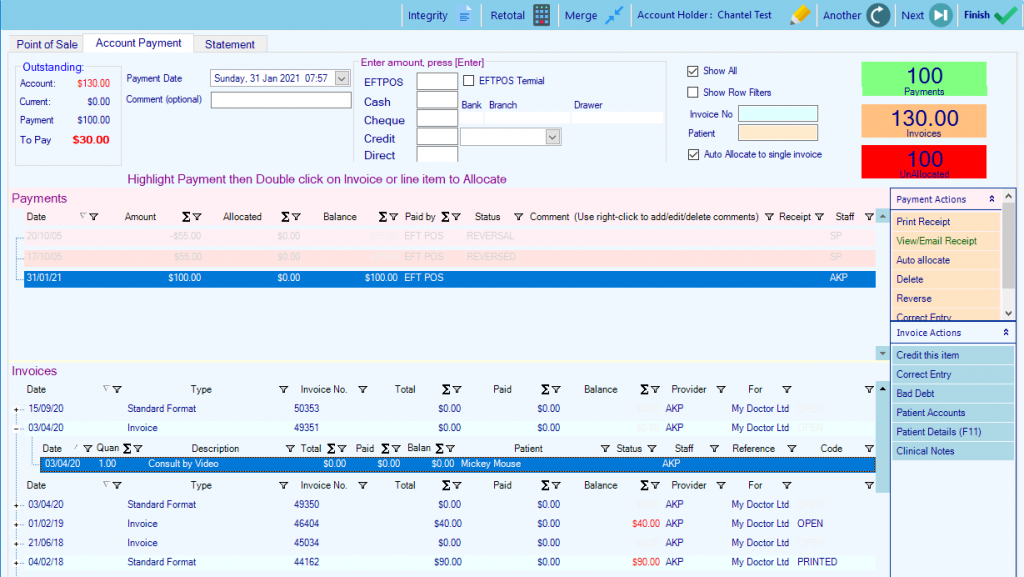

- Click on accounts in the toolbar

- Select the account holder

- Click on the Accounts Payment Tab

n.b. You will need the appropriate user permissions for these tasks

Invoices and invoice line items

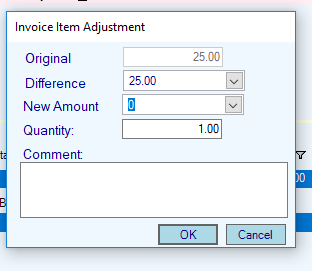

Correcting a mistake

If an entry has been made by mistake. (On the same day and the invoice has not been printed, try deleting it first)

- Highlight the item

- Choose Correct Entry in the invoice actions

- Enter the correct amount as the New Amount. (Enter 0 to cancel the invoice)

- Enter a comment to explain your reason for changing this invoice

- The item with have it’s status changed to Corrected

- A new counter-balancing Correction item will be created with the same date as the original item

- Any allocations will be removed

Crediting the invoice

If an entry has been made by correctly but has been subsequently rejected

- Highlight the invoice or the invoice line item

- Choose Credit Item in the invoice actions (Choose Credit All Items in the right-click menu to process all line items in an invoice)

- Enter the New Amount. (Enter 0 to totally cancel the invoice)

- Enter a comment to explain your reason for changing this invoice

- The item with have it’s status changed to Credited

- A new counter-balancing Credit item will be created with today’s date.

- Any allocations will be removed

Bad Debiting the invoice

If an entry has been made by correctly but subsequently the decision made not to pursue payment

- Highlight the invoice or the invoice line item and choose Bad Debt in the invoice actions

- Enter the New Amount. (Enter 0 to totally cancel the invoice)

- Enter a comment to explain your reason for changing this invoice

- The item with have it’s status changed to Bad Debted

- A new counter-balancing Bad Debt item will be created with today’s date.

(Multiple items can be highlighted together to process bulk entries)

Payments

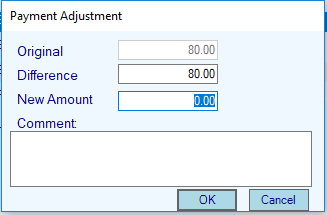

Correcting a mistake

If an entry has been made by mistake. (On the same day and the payment has not been printed, try deleting it first)

- Highlight the payment

- Choose Correct Entry in the payment actions

- Enter the correct amount as the New Amount. (Enter 0 to cancel the payment)

- Enter a comment to explain your reason for changing this payment

- The item with have it’s status changed to Corrected

- A new counter-balancing Correction item will be created with the same date as the original item

- Any allocations will be removed

Reversing a payment

If an entry has been made by correctly but has been subsequently rejected by the bank (e.g. a bounced cheque)

- Highlight the payment

- Choose Reverse in the payment actions

- Enter the New Amount. (Enter 0 to totally cancel the payment)

- Enter a comment to explain your reason for changing this payment

- The item with have it’s status changed to Reversed

- A new counter-balancing Reversal item will be created with today’s date.

- Any allocations will be removed

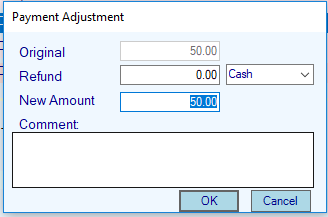

Refunds

Payments can be refunded.

- Highlight the payment and choose Refund in the payment actions

- Enter the Refund or New Amount.

- Enter the refund method.

- Enter a comment to explain your reason for refunding this payment

- The item with have it’s status changed to Refunded

- A new counter-balancing Refund item will be created with today’s date.

- Any allocations will be removed

Previous

Next